World-Class Expertise and Technology

Insight has been able to pull together an array of global capabilities and technologies that are unlike any other company in the industry. Our early investments in cloud, data, AI and cybersecurity position us for success in the fastest growing areas of the market where our clients need the most help.

We are not only an expert in today’s technology, but the emerging solutions that will drive the next wave of innovation among businesses.

We help clients drive digital transformation

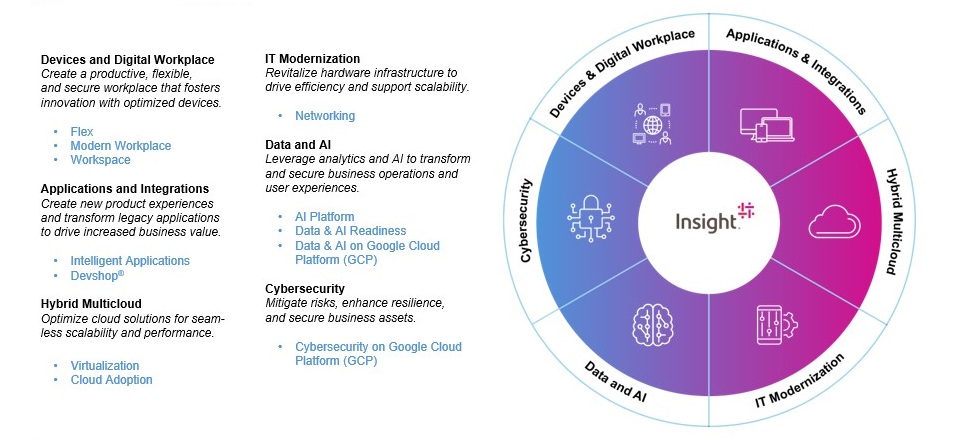

Our expertise includes:

- Modern Workplace - Create a productive, flexible and secure workplace.

- Modern Apps - Create new product experiences and transform legacy applications to drive increased business value.

- Modern Infrastructure - Architect and modernize multiclous and networking solutions to drive business transformation.

- Intelligent Edge - Gather and utilize data in the most efficient way possible to enable real-time decision-making and affect pivotal outcomes.

- Data and AI - Leverage analytics and AI to transform business operations and user experiences.

- Cybersecurity - Mitigate risks and secure business assets.

Our services includes:

- Consulting services - Create competitive advantage and improve operations by aligning business goals to IT and product strategies.

- Hardware, Software and Lifecycle Services - Simplify supply chain and streamline costs across the global hardware and software lifecycle.

- Managed Services - Eliminate business disruption and strategically align resources.

Global Scale and Reach

Insight’s global presence enables reach and scale, with access to technology partners all over the world. We can deliver solutions globally, leveraging our teammates in 26 countries and partners around the world. We have time-tested relationships with thousands of customers, some spanning decades.

Track Record of Financial Strength

Our long, stable history and financial strength make Insight the most consistent and reliable partner in the technology industry. Recent performance metrics include:

Additional financial information available here.

Significant and Achievable Five-Year Financial Targets

Over the next five years, Insight expects to grow faster than the market by over 200 bps, achieving profitable growth and sustainable margin expansion. Additional five-year growth targets include:

Strong Cash Generation and Value Creation

Our leadership team remains focused on strengthening the Company’s cash generation, boasting significant cash flow while delivering value to shareholders through a disciplined capital allocation strategy. Our specific capital allocation priorities include:

- Organic growth focused on automation to increase efficiency and capacity, expand scalable IT and service delivery platforms, and grow technical and sales talent capabilities.

- M&A with cultural, strategic and financial alignment to Insight, with the goal that companies are accretive within the first full year following acquisition and ROIC is 300 bps above WACC at end of year three.

- Increase cash flow generation and return greater capital to shareholders.

- Limited debt usage, allowing us full capacity to support future M&A.